Financing Options - Starting at 0% APR*

Financing With

Real Estate Institute has teamed up with Affirm to offer easy financing—without a catch. With fixed monthly payments, you can buy Real Estate Institute's real estate, mortgage, and insurance pre-licensing courses*. It's as easy as 1, 2, 3, 4.

Enroll Now, Pay Later

There are no gimmicks like deferred interest or hidden fees—the total you see at checkout with Affirm is always what you'll pay. Choose "Financing with Affirm" at checkout and provide basic information for a real-time decision. If approved, split your purchase into 3, 6, or 12 monthly payments with rates from 0-36% Annual Percentage Rate (APR)*.

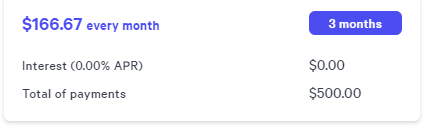

For example, a $500 registration fee can be broken up into three (3) monthly payments of $166.67/mo at 0% APR*

How Does It Work?

Click "Enroll Now" for the course you wish to purchase.

Select Affirm as your payment method.

Fill out quick and easy application. Get a real-time decision!

Complete order and pay over time!

FAQs

Why did Real Estate Institute choose to partner with Affirm?

Affirm offers financing options that enable our students to enroll today and pay later. This extends our traditional payment options, such as credit/debit cards and cash.

We chose Affirm as our financing partner because they offer

easy financing without a catch. There are no gimmicks like deferred interest, so the total you see at checkout with Affirm is always what you’ll actually pay. Checkout is quick and simple, safe, and secure. You’re in control, since

you pick the loan that fits your budget.

Are there any interest or fees associated with Affirm loans?

Affirm loans vary between 10% and 30% APR (promotional interest rates may be offered from time-to-time). The corresponding finance charge is the only fee associated with an Affirm loan - Affirm does not charge late fees, service fees, prepayment fees, or any other hidden fees. Affirm loans also only accrue simple interest — not compound interest — which means you won't be charged interest upon interest. Affirm always strives to be more transparent and fair than any other form of financing.

What is required to have an Affirm account?

To sign up for Affirm, you must:

- Be 18 years or older (19 years or older in Alabama or if you’re a ward of the state in Nebraska).

- Provide a valid U.S. or APO/FPO/DPO home address.

- Provide a valid U.S. mobile or VoIP number and agree to receive SMS texts. The phone account must be registered in your name.

- Provide your full name, email address, date of birth, and the last 4 digits of your social security number to help Affirm verify your identity.

Does Affirm perform a credit check?

Yes, when you first create an Affirm account, they perform a ‘soft’ credit check to help verify your identity and determine your eligibility for financing. This ‘soft’ credit check will not affect your credit score.

If you apply for

more loans with Affirm, they may perform additional ‘soft’ credit checks to ensure that they offer you the best financing options possible.

Is my personal information secure with Affirm?

Yes, protecting your personal information is very important to Affirm. Affirm encrypts all sensitive data including social security numbers. Affirm also maintains physical, electronic, and procedural safeguards to protect your information. Affirm does not sell or rent your information to third parties. You can read more about Affirm’s Privacy Policy here.

Where can I get more information about Affirm?

Feel free to check out Affirm’s complete list of FAQs.

Affirm loans are made by Cross River Bank, a New Jersey-chartered bank, Member FDIC.

Have Additional Questions?

Visit the Help CenterRefer to our School Policies for course expirations, refunds, and more.

*Exception: Financing is not currently available for the Online Instructor-Led Mortgage Pre-Licensing course.

**Your rate will be 0-36% based on credit and is subject to an eligibility check. Payment options through Affirm are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required.